New 2 Deposit

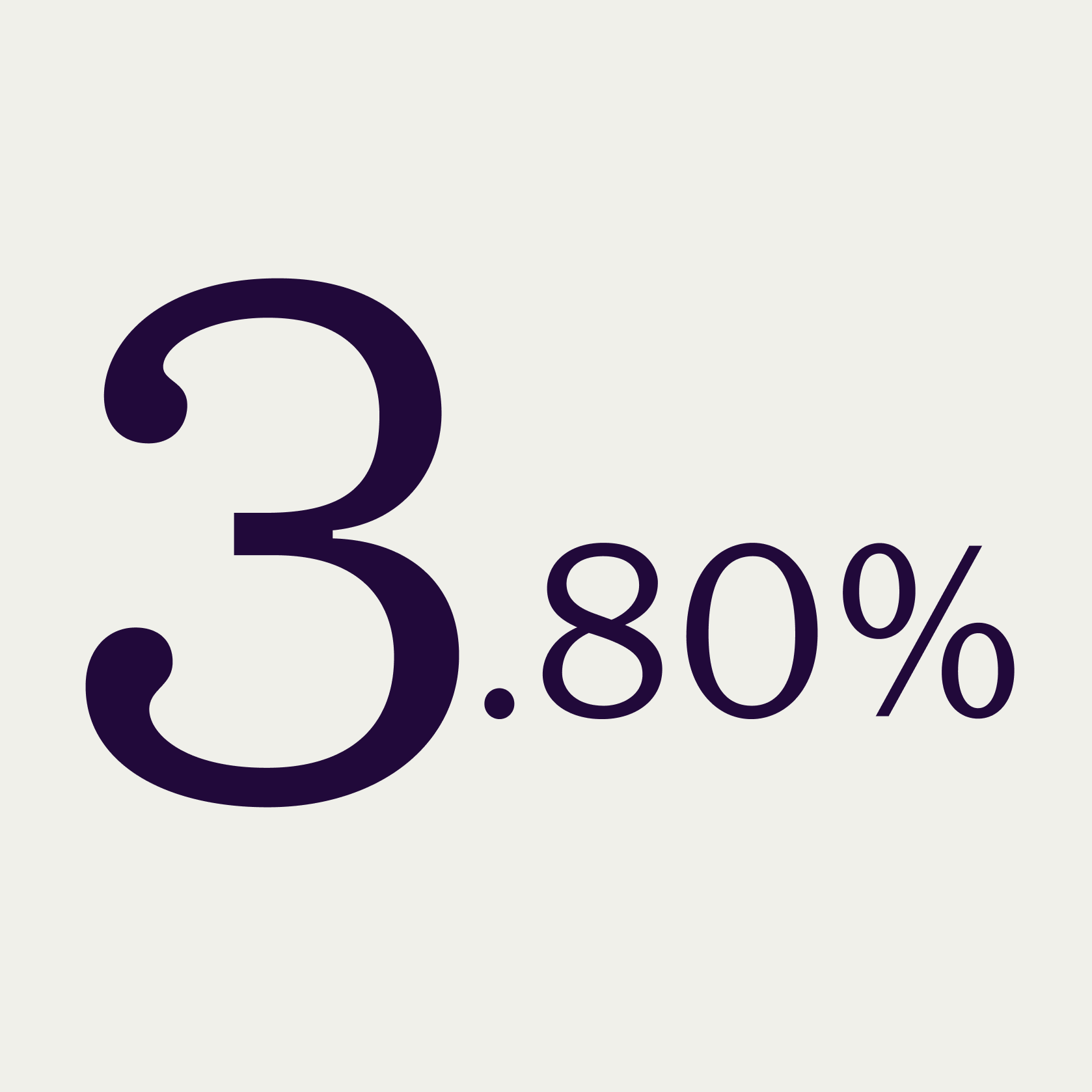

New 2 Deposit at %

The interest rate of % per annum applies to New Customers and first deposit of months. Visit the “How can I apply for New2Deposit?" section below and make sure you meet the conditions.

Calculate your profit

See how much you’ll earn over the chosen period of time if you open a deposit today.

Annual interest rate

%

Your earnings in interest * -

Deposits opened in Inbank are guaranteed by an Estonian guarantee fund - Tagatisfond, Roosikrantsi 2, 10119 Tallinn, Estonia, www.tf.ee. This fund is the equivalent of the Czech Deposit Insurance Fund.

*Amount of interest before income tax.

Among the best rates

Grow your savings stress-free with our term deposit, where your money is safe and your interest is among the highest on the market.

Let your money work for you

Safe and secure

Amount guaranteed by the National Guarantee Fund making deposits as safe as they can be.

Attractive fixed interest

Deposit with good interest rates without leaving your home bank or signing on to any additional services.

All-online service

Set up and manage your deposits from the comfort of your home or on the go.

Frequently asked questions

Only new clients who have not yet arranged any deposit with Inbank can arrange a New2Deposit. The preferential interest rate applies to the first deposit period. The interest rate for subsequent deposit periods or for the second and each additional new New2Deposit will be set (even retrospectively after the deposit has been arranged) at the interest rate valid at the time the deposit is arranged for standard term deposits.

In the Personal tab, click on the Deposits link. Calculate how much you want to deposit and for how long, and how much interest we will credit you. Next, click on the "Open a deposit" button. If you are already a client, log in to your Inbank online banking, if not, we will ask you to prove your identity. Then just fill out a simple and short application. After completing the application and agreeing on the contract, make a transfer from your bank account in the amount of your chosen deposit, using the reference number you will find in the contract. The amount of the deposit must be transferred to the Inbank account within 7 days of the conclusion of the contract, otherwise the contract will be automatically cancelled.

Anyone who is 18 years of age, a natural person having Czech tax residency and has Czech citizenship or permanent residence in the Czech Republic. Within know-your-customer process we will ask you for identifying yourself, you can use convenient way of Bank iD or send us copy of your IDs along with verification payment from your Czech bank account.

You can transfer the money intended as a deposit in Inbank very easily already during its negotiation (and no longer than 7 days after the conclusion of the contract) by using the PSD2 PIS service. You do not have to enter the transfer at your bank, we will prepare everything for you and you just confirm it in your online banking. Of course, you can make a one-off transfer from your bank to our account with the appropriate reference number. You will find the payment details after you have arranged the deposit account by logging into your Inbank online banking. In the Deposits tab, search for your deposit account, click on the details and then on the button "Deposit funds to deposit account"

Yes - both at the stage of concluding the deposit agreement and during the term of the deposit, you can choose whether the deposit should be automatically renewed. The deposit is renewed with interest on a new deposit for the same period as the original deposit and has an interest rate according to rates applicable to deposits on the renewal date. In the case of automatic renewal of the deposit, Inbank may increase the interest rate after the renewal with a bonus. After the automatic renewal, the deposit can be terminated at any time without losing the interest accrued before the renewal. If you want to change the termination or renewal options, you can do so no later than 2 days before the maturity date of the deposit.

After terminating or ending the deposit (unless you have chosen the automatic renewal option), we will transfer the funds to the account from which you credited the deposit. We transfer the funds at the latest on the next business day after the end of the deposit. If your bank account has changed, please inform us by sending a message from the e-mail address provided in Inbank.

You can cancel your deposit at any time on the grounds and according to the procedure provided for by effective law or the General Terms and Conditions of AS Inbank by submitting a written application to info@inbank.cz. In case we satisfy your application Inbank will not pay interest for the deposit period in the case of early termination. The deposit amount will be paid back to the customer account after 30 days from the expiry of the deposit contract. If you would like to get the deposit amount earlier, Inbank has the right to request the early payout fee according to the effective price list.

Interest from deposits is subject to withholding tax in the Czech Republic. The interest paid to the client is already reduced by the 15% tax paid by Inbank on your behalf.